Managing accounts receivable (AR) is a critical aspect of a company’s financial health. Proper receivables management ensures that businesses maintain a steady cash flow, minimize bad debts, and optimize their working capital. This comprehensive guide delves into various facets of accounts receivable, including turnover ratios, collections, and best practices for effective management.

Understanding Accounts Receivable

Accounts receivable represent the outstanding invoices a company has or the money it is owed from its clients. This asset is recorded on the balance sheet and is crucial for maintaining the liquidity of a business. Efficient accounts receivable management helps companies keep track of incoming payments and ensures they are collected in a timely manner.

Accounts Receivable Process

The accounts receivable process involves several steps:

- Invoicing: Sending detailed and accurate invoices to customers promptly after the delivery of goods or services.

- Tracking: Monitoring invoices to ensure payments are received within the agreed-upon terms.

- Collections: Following up on overdue payments through reminders, emails, and calls.

- Reconciliation: Ensuring all received payments are accurately recorded and matched with the corresponding invoices.

Accounts Receivable Turnover

The accounts receivable turnover ratio measures how efficiently a company collects its receivables. It is calculated by dividing net credit sales by the average accounts receivable during a specific period. A high turnover ratio indicates efficient collections, while a low ratio may signal issues with the credit policies or collection processes.

Accounts Receivable Turnover Calculator

To simplify the calculation, businesses can use an accounts receivable turnover calculator. Inputting the relevant figures—net credit sales and average accounts receivable—provides an instant turnover ratio, helping companies gauge their collection efficiency.

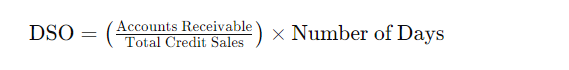

DSO Calculation

Days Sales Outstanding (DSO) is another critical metric, reflecting the average number of days it takes a company to collect payment after a sale. It is calculated using the formula:

A lower DSO indicates faster collections, while a higher DSO may point to inefficiencies in the receivables process.

Receivables Management Strategies

Effective receivables management involves several strategies:

- Credit Policies: Establish clear credit policies, including credit limits and payment terms, to ensure customers understand their obligations.

- Customer Screening: Conduct thorough credit checks on new customers to assess their creditworthiness.

- Invoicing Practices: Implement efficient invoicing practices, such as sending invoices promptly and providing multiple payment options.

- Collections Process: Develop a robust collections process, including automated reminders and follow-up calls for overdue accounts.

- Incentives and Penalties: Offer early payment discounts to encourage timely payments and impose late fees for overdue invoices.

Accounts Receivable Management Tools

Modern tools and software can significantly enhance accounts receivable management. These solutions provide automated invoicing, real-time tracking, and detailed reporting, helping businesses streamline their receivables process and reduce the risk of bad debts.

Best Practices for Accounts Receivable Collections

- Clear Communication: Ensure all invoices and payment terms are clearly communicated to customers.

- Consistent Follow-Up: Regularly follow up on overdue invoices through automated reminders and personal calls.

- Customer Relationships: Maintain good relationships with customers to foster timely payments and address any payment issues promptly.

- Negotiation: Be willing to negotiate payment plans with customers facing financial difficulties to secure partial payments instead of no payment.

Optimizing Accounts Receivable Turnover Ratio

Improving the accounts receivable turnover ratio involves:

- Streamlining Invoicing: Ensure invoices are sent promptly and accurately.

- Enforcing Credit Policies: Stick to established credit policies and review them periodically.

- Enhancing Collections: Implement effective collections strategies to minimize overdue accounts.

- Monitoring Metrics: Regularly monitor AR metrics, such as turnover ratio and DSO, to identify and address issues promptly.

Conclusion

Mastering accounts receivable management is crucial for maintaining a healthy cash flow and ensuring the financial stability of a business. By understanding key concepts like the accounts receivable turnover ratio and DSO calculation, and implementing best practices in receivables management, companies can optimize their collections process and improve their overall financial performance.

Investing in modern AR management tools and maintaining clear communication with customers will further enhance the efficiency of the accounts receivable process. Ultimately, effective AR management not only boosts cash flow but also strengthens customer relationships and supports long-term business growth.