Running a business is like solving a puzzle – every piece matters for the big picture. But what about those hidden costs that seem to lurk in the shadows? We’re talking about overhead costs, those essential expenses that keep your business running smoothly but aren’t directly tied to making a single product or providing a service.

Understanding and managing overhead costs is crucial for any business owner who wants to maximize profits and achieve long-term success. This guide will break down the hidden language of overhead costs, making them crystal clear for you.

Demystifying Overhead Costs: What They Are (and Aren’t)

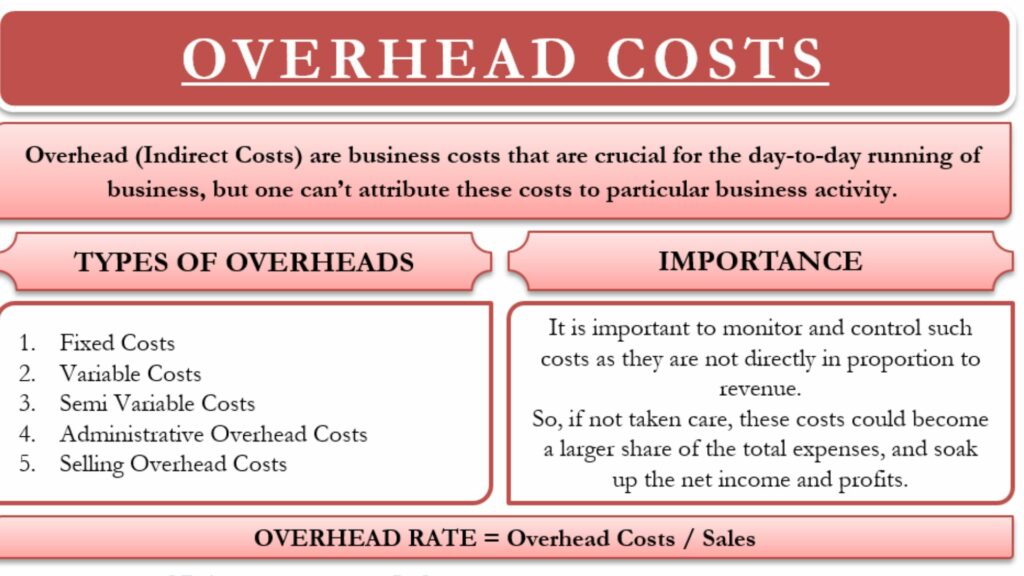

In cost accounting, overhead costs (also referred to as overheads) encompass all the indirect expenses a business incurs to operate. Think of it like the electricity that powers your workshop or the rent you pay for your office space. These costs are essential, but they’re not directly tied to a specific unit of what you produce or sell.

Here’s a quick way to remember what is overhead in cost accounting:

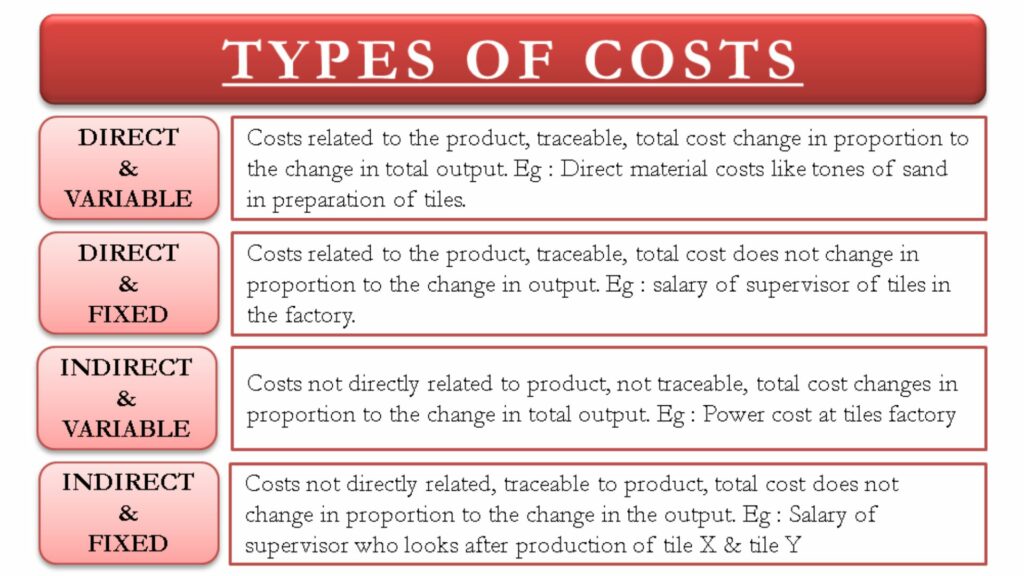

- Direct Materials: The raw materials that physically become part of your finished product (e.g., wood for furniture, fabric for clothing).

- Direct Labor: The wages paid to employees directly involved in producing your product or service (e.g., factory workers, construction crew).

Why Overhead Costs Matter: The Invisible Powerhouse

While indirect, overhead in cost accounting play a vital role in keeping your business running like a well-oiled machine. They contribute to a variety of areas, including:

- Daily Operations: Rent, utilities, office supplies, and internet bills.

- Keeping Things Organized: Salaries for administrative staff, accounting fees, and legal expenses.

- Spreading the Word: Advertising costs, travel expenses, and sales commissions.

- Staying Protected: Property insurance, liability insurance, and business licenses.

- Long-Term Investments: Depreciation, which accounts for the gradual decrease in value of equipment and assets over time.

Allocating Overhead Costs: Spreading the Love (or the Expense)

Since overhead costs aren’t directly linked to individual units of production, allocating them accurately requires specific methods. Common allocation methods include:

- Direct Labor Hours: Overhead costs are allocated based on the total direct labor hours used to produce each unit. (Think of it like dividing the cost of workshop electricity by the total labor hours spent building furniture.)

- Machine Hours: Overhead costs are allocated based on the total machine hours used to produce each unit. (This might be relevant if you run a factory where machines are the primary production force.)

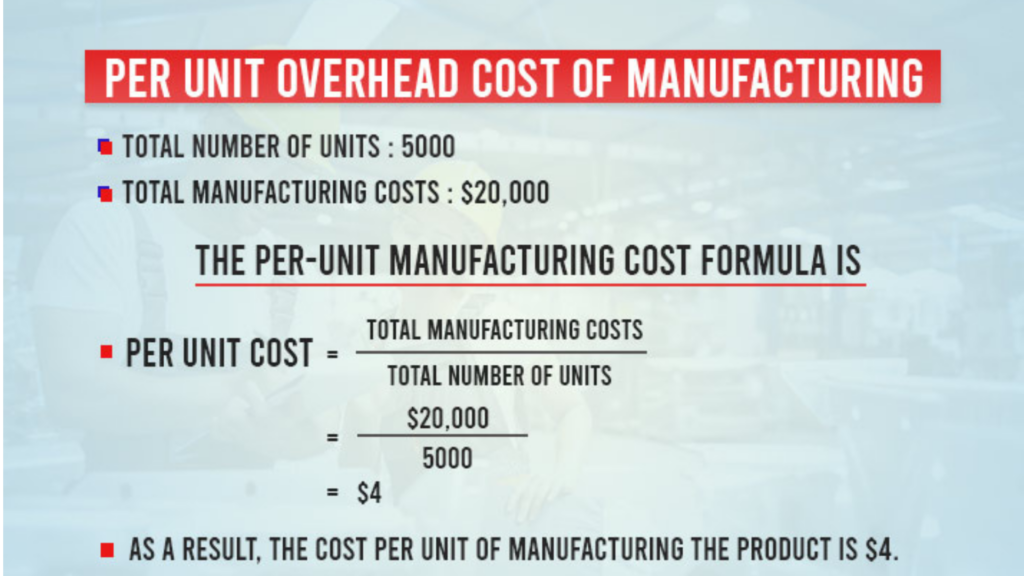

- Units Produced: Overhead costs are allocated based on the total number of units produced. (This is a simple method, but it might not be the most accurate for businesses with complex production processes.)

The best allocation method depends on your specific business and production process.

Types of Overhead Costs: Not All Expenses Are Created Equal

Overhead costs can be further categorized based on how they fluctuate:

- Variable Overheads: These costs fluctuate with production volume, such as utilities or some types of manufacturing supplies. (The more you produce, the more electricity you use.)

- Fixed Overheads: These costs remain constant regardless of production volume, like rent or salaries for administrative staff. (Your rent payment stays the same even if you produce fewer units.)

- Semi-Variable Overheads: A mix of both variable and fixed costs, such as some maintenance expenses that may increase slightly with production levels. (Think of routine maintenance for equipment that might need more attention with higher production volume.)

Understanding these classifications helps you predict and potentially control costs.

Overhead Cost Variance: The Art of Spotting the Difference

Overhead cost variance is the difference between the actual overhead costs incurred and the budgeted overhead costs. Analyzing this variance helps you identify areas for cost reduction or potential budgeting errors. (Imagine budgeting for a certain amount of electricity use, but then realizing your actual usage is higher. This variance might point to a need for energy-saving measures.)

Calculating Overhead Costs: How to calculate overhead cost

Calculating overhead costs involves gathering data from expense reports, invoices, and accounting records. Here’s a simplified formula to get you started:

Overhead Rate = Total Overhead Costs / Allocation Base (e.g., Direct Labor Hours, Machine Hours, Units Produced)

Synergistic Solutions: Your Partner in Unraveling the Overhead Puzzle

At Synergistic Solutions, we understand the importance of managing overhead costs effectively. We offer a range of services, including accounting, financial planning, and cost analysis, to help businesses optimize their expenses and achieve financial goals.